ICC Customs & Trade Facilitation Commission Meeting & Forum

| Location: | Dubai Chamber of Commerce & Industry |

| Date: | 17-18th May 2017 |

| Event Type: | Meeting & Forum |

| Language: | English |

Description

Dubai Chamber of Commerce & Industry, ICC-UAE and ICC will organize its Customs and Trade Facilitation Commission Meeting to be held on Wednesday, 17 May (afternoon) and Thursday, 18 May (full day) 2017 at Dubai Chamber of Commerce & Industry, Dubai, United Arab Emirates.

During the meeting the Commission will continue its strategic work agenda on customs, trade facilitation, transport and logistics, further building on the discussions at the last meeting in November 2016.

The meeting will be held back-to-back with a Customs and Trade Facilitation Forum co-organized by the ICC-UAE and Dubai Chamber of Commerce & Industry in partnership with ICC on the morning of 17 May 2017. To make it even more interesting, ICC will arrange for its members a tour of the Jebel Ali Free Trade Zone – one of the fastest growing free trade zones – to take place the day before the Commission meeting on 16 May 2017.

- Rooms in the ICC room block will be attributed on a first come first served basis;

- The preferential room rates are strictly confidential and granted to ICC delegates only. They must in no way be disclosed.

- Please make sure to indicate you will be attending an event with the Dubai Chamber of Commerce and Industry.

Logistical Notes

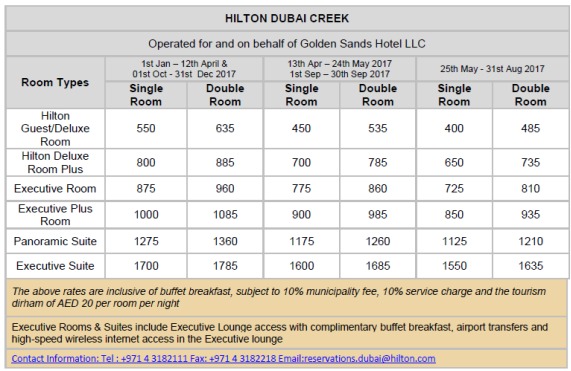

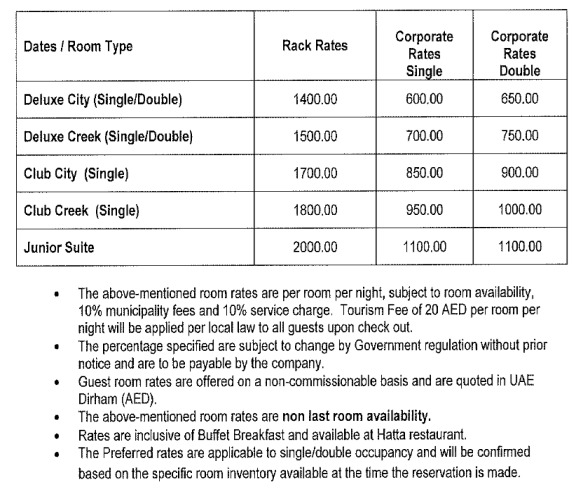

HOTEL LIST

ICC-UAE and the Dubai Chamber of Commerce and Industry have kindly negotiated preferential room rates for both the Sheraton Dubai Creek and Hilton Dubai Creek hotels. Both hotels are within walking distance of the venue.

ROOM RATES

BOOKING CONTACTS

Registration

Customs & Trade Facilitation Forum

Dubai Chamber of Commerce & Industry

ICC Customs & Trade Facilitation Meeting (For ICC Members Only)

Jebel Ali Free Trade Zone Tour

17th May 2017 (PM) – 18th May (All Day)

Dubai Chamber of Commerce & Industry

Programme

TUESDAY 16 MAY 2017

13:30 Tour of the Jebel Ali Free Trade Zone - one of the fastest growing free trade zones

Transportation will be arranged.

WEDNESDAY 17 MAY 2017

8:30 Registration

9:00 Customs and Trade Facilitation Forum

Co-organized by ICC UAE, the Dubai Chamber of Commerce and Industry and ICC. The forum will touch upon Trade Digitalization, the World Trade Organization (WTO) Trade Facilitation Agreement and Gulf Cooperation Council (GCC) Value-added Tax.

For more information about the programme, please download the brochure.

14:00 ICC Customs and Trade Facilitation Commission meeting

17:30 End of Day 1

THURSDAY 18 MAY 2017

9:30 ICC Customs and Trade Facilitation Commission meeting

12:30 Lunch - kindly provided by ICC UAE/the Dubai Chamber of Commerce and Industry

17:00 Close of meeting.

- BA in Administration and Marketing from Davies and Alkenes University

- In charge of managing one of the biggest federal institution which is the UAE Federation of the Chambers of Commerce and Industry, the official representative of the UAE private sector. He has a long history of accomplishments in the UAE process of modernization and development since 1997, particularly in the Chambers of Commerce and Industry.

- He is considered one of the economic officials who have a clear vision in achieving the managerial missions of private and public enterprises. He focuses on achieving the best results through working with a highly qualified professional team.

- Establishing and participating in the joint Business Councils

- Active participation and contribution in many projects and laws pertaining to Private Sector

Customs & Trade Facilitation Forum

About the Speakers

H.E Humaid Mohamed Ben Salem

Chairman

ICC UAE

Secretary General of the Federation of UAE Chambers of Commerce and Industry Chairman of International Chamber of Commerce – United Arab Emirates (ICC – UAE) Former Member of the UAE National Assembly (Parliament)

Accomplishments

H.E. Hamad Buamim

President and CEO

Dubai Chamber of Commerce and Industry

Deputy Chair - ICC World Chambers Federation

Hamad Buamim has been the President and CEO of Dubai Chamber of Commerce & Industry since November 2006. He also serves as the Deputy Chair of the Paris-based World Chambers Federation – ICC. Educated in the USA, Buamim graduated with Honors (Magna Cum Laude) from the University of Southern California – Los Angeles in 1996 with a Bachelor of Science in Electrical Engineering. In 2002, he obtained an MBA with Honors in Finance from the University of Missouri – Kansas City.

Buamim is a Member of the Board of Directors of the UAE Central Bank, Managing Director and Board Member of Dubai World, Member of the Board of Directors of the Dubai International Financial Centre Authority, Chairman of National General Insurance and Board Member of Union Properties. Previously, Buamim served as Chairman of Emirates Financial Services, Chairman of Emirates NBD Capital, and Board Member of Emirates NBD Bank and Network International.

H.E. Ahmed Mahboob Musabih

Director

Dubai Customs

With more than 21 years of proven experience in Customs work, Ahmed Mahboob has served Dubai Customs since 1994, where he gradually advanced through different managerial and leadership positions.

As Executive Director of Customer Management Division, the role His Excellency assumed for several years, he successfully led the implementation of high-profile corporate projects, such as GCC customs union rules and regulations, ATA Carnet system, IATA e-Freight initiative, Cargo Reconciliation and e-Inspection projects.

He is also an active member in more than twenty local, regional and international task forces and committees, including the GCC Customs Union Technical Committee.

Holder of a Bachelor degree in Sociology from the United Arab Emirates University, Ahmed Mahboob Musabih is considered as one of the most influential young public figures in Dubai and the UAE.

On March 11th 2014, His Excellency Ahmed Mahboob Musabih was appointed as Director of Dubai Customs by virtue of a decree issued by His Highness Sheikh Mohammed Bin Rashid Al Maktoum.

Ana Hinojosa

Director Compliance and Facilitation

World Customs Organization

Director Hinojosa assumed her elected post in the Compliance and Facilitation Directorate of the World Customs Organization (WCO), effective January 1, 2016, after serving nearly 29 years with the United States Custom Service/Customs and Border Protection (CBP).

She leads the WCO directorate that is responsible assisting Members in implementing effective and efficient controls, ensuring fair and accurate revenue collection, and protecting society by intercepting and suppressing illicit and criminal activities. The directorate has the twin goal of securing and facilitating legitimate global supply chains through the simplification and harmonization of Customs procedures. In order to accomplish this, the Directorate, working with WCO Members, develops international standards covering all aspects of trade processes, which encompass the cross border movement of people and goods, and manages a number of international conventions.

Throughout her career with CBP, she held a number of leadership positions in a several different geographic locations in the United States. Although she served most of her career along the US/Mexico land border, she also served in several key leadership positions overseeing major airport operations in the Los Angeles, California, Las Vegas, Nevada, and Dallas/Fort Worth, Texas areas. Following her service as the Director, Field Operations (Regional Director) in the El Paso, Texas region, she served as the Deputy Assistant Commissioner for International Affairs, in Washington, DC through December 2015.

She is fluent in English and Spanish, and is currently studying French.

Kimble Winter

Global Chief Executive Officer

Logistics Executive Group

The founder of Logistics Executive Group, Kim brings 35 years of executive leadership experience spanning Corporate Advisory, M&A, Trade Facilitation, Executive Coaching & Development, Executive Search, Recruitment and Outplacement across the Supply Chain, Aviation, Maritime, E-Commerce, F&B, Logistics, 3PL, Pharma, Industrial, FMCG and Retail sectors.

Commencing operations in 1999, Logistics Executive Group serves customers from offices in Sydney, Melbourne, Brisbane, Perth, Singapore, Hong Kong, Shanghai, Delhi, Mumbai, Chennai, Dubai and London. A professional Master of Ceremonies and Conference Chair, Kim holds an MBA, BA (NZ), is an ex professional rugby layer, board member for a dozen companies and Founder / Chairman of Australian registered (2006) charity Oasis Africa Australia www.oasisafrica.org.au which provides freedom from poverty through education (8000 orphaned children to date) in African slums.

Younis Othman

Director, IT Department

Dubai Customs

As a CIO at Dubai Customs, Younis Othman oversees organization's IT strategy, governance and development, providing by that a stack of stable, secure and high performance services in an innovative and technologyintensive manner. His work has led for a successful transformation into the smart & digital era, hence achieving an outstanding track record of recognition on all levels.

Prior to Dubai-Customs, and being the head of IT Development at General-Directorate-of-Residency-andForeigners-Affairs (DNRD), Younis was behind the centralized eServices portal for issuing visas. He also held the IT Director position at DATEL Systems & Software.

In 2003 Younis has been awarded a key player in the best successful government project (eGate) by H.H Sheikh Mohammed Bin Rashid Al Maktoum.

Norman Schenk

Chair, ICC Commission on Customs & Trade Facilitation

Vice President, Global Customs Policy & Public Affairs, UPS

Norman Schenk, UPS Vice President Global Customs Policy & Public Affairs, is responsible for shaping global customs policy and border strategies to facilitate the smooth flow of shipments across international borders.

With more than 30 years of UPS experience, he was the first U.S. employee for the UPS customs brokerage services in Louisville, Ky. which now has grown to more than 3,000 employees.

Norm currently serves on advisory committees to the U.S. Department of Homeland Security (DHS), U.S. Department of Commerce (DOC), U.S. Department of State, and the World Customs Organization (WCO).

He currently chairs the International Chamber of Commerce (ICC) Commission on Customs and Trade, representing the voice of over 6.5 million businesses worldwide. Norm is also actively involved with the Global Express Association (GEA), Express Association of America (EAA), and the American Association of Exporters & Importers (AAEI). He was appointed to the Commercial Operations Advisory Committee (COAC) in October 2002 and has served two terms on this advisory group to U.S. Customs & Border Protection.

Schenk graduated from Widener University in 1979 with a Bachelor of Science degree in business administration and is a licensed customs broker (1985). He resides in Louisville, KY.

Bashar Kilani

Regional Executive for Middle East

IBM

In his role Bashar oversees the IBM business in the Gulf Countries and the Levant working with clients and partners across industries. Prior to that Bashar was the Business Unit Executive for IBM software business in MENA.

Mr Kilani has a passion for thought leadership around digital transformation, artifi-cial intelligence, Blockchain and has spoken at many international and regional conferences.

Bashar began his career with IBM in the United Kingdom in 1995 and held several executive and managerial positions in software development, services, sales and marketing. He holds an MBA in Management and an M.Sc. in Computer Engineer-ing from Universities of Reading and Surrey in the United Kingdom and B.Sc. in Electrical Engineering from the University of Jordan.

Prof Dr. Christian Kaeser

Chair, ICC Commission on Taxation

Global Head of Tax, Siemens AG

Christian Kaeser studied law at the Johannes Gutenberg University in Mainz/Germany, focusing on tax law and finance (Prof. Dr. Christoph Trzaskalik). After four years as an Assistant Professor for tax law at the Universities of Mainz and Valencia, he completed his JD in 2001. Kaeser then joined a Munich-based tax advisory firm but left to join Siemens AG in 2002. After being responsible for the global tax planning of the Siemens Group and a delegation to the U.S. in 2007 and 2008, he was appointed the Global Head of Tax and Corporate Vice President for Siemens taking over the responsibility for the worldwide tax community of approximately 500 tax experts in 2009.

Kaeser is the Chairman of the Tax Commission of the International Chamber of Commerce (ICC), president of the German Branch of the International Fiscal Association (IFA) and member of the Executive Committee of IFA. He frequently presents at German and international tax conferences, is the author and co-editor of several tax-related publications. Kaeser is the chairman of the supervisory board of WTS Group AG, a German-based tax advisory group, a member of the scientific council of PwC and Professor at the faculty of tax law of the Vienna University for Economics (WU).

Ankur Jain

Senior Manager

KPMG

Ankur is a Senior Manager providing VAT Services and UAE VAT Project Manager based out of Dubai. He has 12 years of indirect tax experience across India and Malaysia, and has worked with another Big 4 for over 6 years Ankur has significant experience on GST/ VAT Advisory and Compliance. He also has experience of GST/ VAT implementation in Malaysia across a wide range of industries. He provides advice on VAT matters which includes advisory, compliance, audit support, litigation support and conducting due – diligence work both in India, Malaysia and now businesses with operations in the UAE. In 2014/15, Ankur was seconded to Deloitte Malaysia from Deloitte India. He was Lead Manager on GST/ VAT implementation projects in Malaysia for a number of listed and multinational entities , encompassing industries such as manufacturing, trading, retailing, pharmaceutical , direct selling, petroleum upstream, agro, entertainment etc..

Ankur has provided advice on VAT Matters on a pan-India basis (29 states) which includes Advisory, Audits, Compliance, Litigation support and conducting due diligence for a number of clients in Manufacturing, Trading, Leasing, Oil & Gas, Confectionary and Pharmaceutical Sectors. He has conducted seminars/ trainings on GST/ VAT and is a regular speaker, providing insights on GST/ VAT at various Forums.

Dr. A. Hadi Shahid

Managing Director

Alliot Hadi Shahid Chartered Accountants

Dr. A. Hadi Shahid is a holder of Ph.D. in Accounting and an accomplished Corporate Executive for 40 years of experience in assurance, accounting, audit and business management advisory with 4 years as area in charge of major accounting firm. He is the Founder and Managing Partner of Alliott Hadi Shahid Chartered Accountants and Alliott Management Consulting. His areas of specialization includes Audit, Commercial Law, Business Advisory, Forensic Accounting and Arbitration Succession Management. His Professional Practise is spread over in many countries. He is a fellow member of the Institute of Chartered Accountants in Pakistan (ICAP). Dr. Shahid is a Certifed Fraud Examiner from USA; fellow of the Institute of Financial Accountants, fellow Member of British Institute of Management, affliate Member of Association of International Accountants, Member of Institute of Islamic Banking and Insurance, UK, Member of Institute of Internal Auditors-UAE Chapter, Chartered Business Consultant (Canada), Chartered Financial Consultant (Canada) and a member of Accountants & Auditors Association, UAE.

Dr. A. Hadi Shahid is on the Board of Directors and Trustee with various Professional, Social and Charitable Organizations in United Arab Emirates, Pakistan and Internationally, Member Advisory Board of Alliott Group-EMEA and President of few charitable hospitals and schools in Pakistan. Dr. Shahid is a well known speaker on various topics of Management and community interest. conducted number of seminars on the Value Added Tax introduction in UAE.

Girish Chand

Director

MCA Management Consultants

Heading the VAT practice for MCA Management Consultants. Conducted various VAT seminars for large companies, professional bodies, industry groups and authorities. Over 25 years experience in Finance and Audit roles 10 years plus finance leadership roles (inclCFO –EPPCO) in the downstream Oil and Gas business covering Marketing, Retail and Trading.

Experience in designing and implementing control frameworks for new and existing business ventures in finance and audit roles. Demonstrated capability in strategy formulation and implementation including business plans and financial modelling for over 10 years.

Well versed in Board level dealings, JV structures and advisory role for Executive Management.

Donia Hammami

Head of Customs and Trade Facilitation, International Chamber of Commerce

Vice President, Global Alliance for Trade Facilitation

Ms. Donia Hammami leads all ICC policy work in the field of Customs and Trade Facilitation at the International Chamber of Commerce (ICC) – the world’s largest business organization with a network of over 6million members in more than 100 countries. In doing so, on behalf of the business community she frequently engages with the World Customs Organization, the OECD, the WTO, UN and the G20. Moreover, Ms Hammami is the Vice-President of the Global Alliance for Trade Facilitation that brings together ICC, the World Economic Forum, the Center for International Private Enterprise and the governments of Germany, Australia, Canada, the United Kingdom and the Unites States, to provide a unique public-private platform in support of the WTO’s Trade Facilitation Agreement (TFA). The Alliance will enhance awareness on the importance of commercially meaningful trade facilitation reforms, and leverage private sector expertise, leadership and resources to help deliver on the potential of the TFA to enable trade-led development.

H.E. Sultan Darwish

Director of Trade Negotiations & WTO Department

UAE Ministry of Economy

Sultan Darwish is the Director of Trade Negotiations & World Trade Organization Department of UAE Ministry of Economy. He represents the Ministry as a director of negotiation in Free Trade Agreements with in the GCC and participates in negotiation with other countries and communities. Darwish is involve in defining UAE positions in WTO and FTA's negotiations, studying business partners' proposal, analyzing offers to UAE and preparing the UAE request to the other party. He is in charge of notifications and data requested from UAE and follows up with government entity. He also coordinates with the office in WTO Geneva and the other commercial offices globally. Sultan Darwish studied Bachelor Degree in Public Administration at UAE University and also certified by World Customs Organization for capacity building.

Sultan Darwish previously worked at Federal Customs Authority as Director of International Relations.

Dr. Alaa Ezz

Secretary General

Federation of Egyptian Chambers, Eurochamber-Egypt & ICC Egypt

Dr. Ezz has over 25 years experience in supporting regional integration, trade & investment, and socio-economic development, as UNDP, private sector, and business federations. Presently he is a first undersecretary of state, the secretary general of the Federation of Egyptian Chambers, the Confederation of Egyptian European Chambers, the Egyptian division of the International Chamber of Commerce, the Egyptian Russian and the Egyptian-German Business Councils, and the Association of Enterprises for Environmental Conservation; the vice president of the Associació Mediterrània del Medi Ambient; the executive board member of the Med Alliance, ASCAME, BusinessMed and the German Arab Chamber; and managing editor of Environment Today and Economy Today Magazines.

Carlos Grau Tanner

Director General

Global Express Association

Carlos Grau Tanner is the Director General of the Global Express Association (GEA), which he joined in March 2010. GEA represents the three leading express delivery carriers (DHL Express, FedEx Express/TNT and UPS). In this capacity, he is involved in international policy issues in the areas of trade, trade facilitation, customs, post, and civil aviation, including air cargo security.

Mr Grau holds a Law Degree from the University of Barcelona, Spain, and a Master of Arts degree in Law and Diplomacy from The Fletcher School at Tufts University in Boston, USA.

Before joining GEA Mr Grau was Director, Government and Industry Affairs at the International Air Transport Association (IATA), and General Manager, Gov’t and Industry Affairs at Swissair. Previously he worked for five years as an international civil servant at the Council of Europe in Strasbourg, France.

Eng. Mahmood Al Bastaki

Chair, ICC UAE Commission on Customs and Trade Facilitation

CEO, Dubai Trade

An expert in e-commerce solutions, Al Bastaki served as the Chief Information Officer (CIO) of Dubai World Corporate Departments before taking up his current position as the CEO of Dubai Trade, the premier trade facilitation entity. He was appointed as an Advisor for the Dubai Expo 2020 bid team. A Member of The UAE National Committee of World Trade Organisation, and a Chairman of Customs & Trade Facilitation Commission - International Chamber of Commerce (ICC) – UAE Chapter. Al Bastaki is also the Advisory Board Member in the “National Association of Freight and Logistics - NAFL”, and a Member of the External Advisory Council at the University of Wollongong.

Al Bastaki holds a Master Degree in Electrical Engineering from Oregon Graduate Institute in USA (1998) and received a Bachelor of Science degree in Electronics Engineering Technology from the University of Arkansas in Little Rock, USA in 1993.

- Access to key decisions makers.

- Network and exhibit directly in front of more than 50 top decision makers in your industry.

- Maximize brand visibility onine and online.

- Stay ahead of the competition by showing your brand at a cutting edge forum and leverage your brand impact through a wide range of sponsorship benefits that promise a significant return on your investment.

- Meet your potential customers face to face.

- Take advantage of the unrivalled networking opportunity that this prestigious gathering provides and create new business leads to stay visible with your customers.

- Share your opinion and position yourself as industry leader.

- Speak at the Customs & Trade Facilitation Forum and share your opinions on upcoming trends.

Customs & Trade Facilitation Forum

Sponsorship Opportunities

Sponsoring the forum offers an ideal opportunity to promote your firm or organization. Sponsors receive maximum visibility during the promotional phase, onsite and also following the Forum. As a truly global organization, we have a global audience.

Why Sponsor?

Sponsorship Category

Platinum Sponsor

A multi-layered prominent sponsorship package offering a combination of thought leader- ship, high-level networking and brand exposure.

Gold SponsorA unique sponsorship package to increase your organization’s brand awareness through different exclusive channels.

Silver SponsorCombining networking and exhibiting with a special opportunity to showcase your company to the Top C-level delegates.

Bronze SponsorGreat opportunity to showcase your organization and network with high level delegates.

For more information about sponsorship, please download the brochure.

Presentations

Panel - Trade Digitalization

Younis Othman

Director, IT Department

Dubai Customs

![]() Download Presentation

Download Presentation

Bashar Kilani

Regional Executive for Middle East

IBM

![]() Download Presentation

Download Presentation

Gulf Cooperation Council VAT Implementation Framework

Ankur Jain

Senior Manager

KPMG

![]() Download Presentation

Download Presentation

Dr. A. Hadi Shahid

Managing Director

Alliot Hadi Shahid Chartered Accountants

![]() Download Presentation

Download Presentation

Girish Chand

Director

MCA Management Consultants

![]() Download Presentation

Download Presentation

Photos

Press Release

Forum seeks to coordinate efforts to facilitate global trade

Wednesday, May 17, 2017

- Dubai Chamber hosts Customs & Trade Facilitation Forum for the first time in cooperation with ICC-UAE

- Event highlighted industry trends and benefits of implementing the WTO’s Trade Facilitation Agreement

- Nasib: Dubai is an ideal setting host this forum as a global leader in trade facilitation with efficient customs procedures

- Ben Salem: Hosting of this forum in UAE shows recognition of country’s status among international community

The Dubai Chamber of Commerce and Industry hosted the Customs and Trade Facilitation Forum at its premises on Wednesday in cooperation with the UAE Chapter of the International Chamber of Commerce (ICC-UAE).

The forum, organised by Dubai Chamber in partnership with the ICC, was supported by the Federation of UAE Chambers of Commerce and Industry. The event was attended by more than 100 delegates, including senior officials from the ICC, ICC-UAE, World Customs Organization, Dubai Customs, and representatives from Dubai’s business community.

During the event, industry experts shared insights on key trends and issues impacting global trade, including digitalisation, challenges and opportunities associated with e-commerce growth, the benefits of implementing the World Trade Organization’s Trade Facilitation Agreement, and the framework for the forthcoming GCC-wide value-added tax (VAT).

Addressing the delegates, Mr. Atiq Juma Nasib, Senior Vice President of Commercial Services, Dubai Chamber, said that Dubai is an ideal setting to host the forum as the emirate is recognised as a global leader in trade facilitation, while it also boasts world-class logistics infrastructure and efficient customs solutions.

He explained that the UAE was the first Arab country to ratify the World Trade Organization’s Trade Facilitation Agreement, adding that this move reflects the country’s strong commitment to facilitating and enhancing international trade.

Mr. Nasib said the implementation of the milestone agreement stands to significantly benefit businesses and SMEs in particular, as it will simplify customs procedures, improve efficiency, and reduce costs.

He highlighted recent research from the World Economic Forum suggesting that the implementation of the Trade Facilitation Agreement could lead to a 60% to 80% increase in cross-border SME sales in some economies.

He emphasised Dubai Chamber’s commitment to working with the ICC and the ICC-UAE to facilitate international trade, address challenges faced by the private sector, and develop strategies to stimulate trade growth.

H.E. Humaid Mohamed Ben Salem, Chairman of the ICC-UAE, highlighted the organisation’s recent achievements and revealed that a total of 500,000 companies are registered with various chambers of commerce across the UAE.

The ICC-UAE Chairman explained that the UAE’s hosting of the ICC Commission on Customs and Trade Facilitation’s meeting for the first time showed the recognition of the country’s status among the international community. H.E. Ben Salem provided an overview of the ICC-UAE’s recent activities and its plan of action for 2017, which he says will help achieve the ICC’s objectives of promoting and facilitating global trade.

H.E. Ahmed Mahboob Musabih, Director of Dubai Customs, affirmed that Dubai Customs has sought to keep pace with Dubai’s positioning as one of the world’s largest cargo hubs by constantly improving its customs efficiency to enable traders and customers to achieve their goal of getting goods to the market as quickly as possible.

“The development of customs work, for us, is an ongoing process which is also in line with our vision to be the leading customs administration in the world supporting legitimate trade. The longstanding commitment to innovation in customs procedures and services have helped significantly speed up the processing of client declarations which reached 9.1 million declarations in 2016,” said H.E. Musabih.

Over the last decade, Dubai’s non-oil foreign trade has experienced a five-time growth from just AED 252 billion in 2003 to AED 1.27 trillion in 2016, H.E. Musabih revealed, adding that the IMF’s projection of 3.3% non-oil growth for the UAE in 2017 will likely drive trade and Expo 2020 investment.

Ana Hinojosa, Director of Compliance and Facilitation, World Customs Organization (WCO), praised Dubai's efforts to digitise and streamline its customs procedures and noted that the emirate is recognised as an early adopter of smart solutions that facilitate and enhance trade.

She identified a number of challenges faced by the WCO and its members related to security and automation, and stressed the importance of collaboration between chambers of commerce and customs authorities around the world to solve such issues.

Panel discussions during the forum focused on the growth of e-commerce and the challenges that it has posed to countries and customs authorities. Around 12% of all global trade transactions are carried out through digital platforms, delegates pointed out, adding that more cooperation is needed to measure the impact of this activity on customs processes around the world.

Contact Us

For more information, please contact Habibullah Rizwan at habib@iccuae.com or by phone to +971 4 220 8288.

Feedback - Customs & Trade Facilitation Forum

Please take a few moments to complete the survey and let us know how we can improve our events. Click Here for Survey